24 januari 2017

Philip maakt cijfers vierde kwartaal en jaarcijfers 2016 bekend

Philips behaalt in het vierde kwartaal een verbetering van de gecorrigeerde EBITA met 19% naar EUR 1 miljard, een nettoresultaat van EUR 640 miljoen en omzet van EUR 7,2 miljard, met een toename van het HealthTech-portfolio met 5%

Kerncijfers vierde kwartaal Kerncijfers hele jaar Frans van Houten, CEO: “Uit de prestaties van ons HealthTech-portfolio in het vierde kwartaal van 2016 blijkt dat onze strategische focus vruchten afwerpt. Ik ben verheugd over de vergelijkbare omzetgroei van 5% en de verbetering van de gecorrigeerde EBITA-marge met 190 basispunten naar 15,3%, met groei en margeverbeteringen voor alle segmenten van ons HealthTech-portfolio. Over het hele jaar bedroeg de vergelijkbare omzetgroei van het HealthTech-portfolio ook 5%, terwijl de gecorrigeerde EBITA-marge een aanhoudende verbetering vertoont. Op groepsniveau kwam de vergelijkbare omzetgroei in het vierde kwartaal uit op 3%, en operationele verbeteringen hebben geleid tot een verbetering van de gecorrigeerde EBITA-marge met 190 basispunten. Onze sterke oplossingen hebben geleid tot een aanmerkelijke uitbreiding van onze langlopende strategische samenwerkingen: we hebben 15 nieuwe meerjarencontracten gesloten met een gezamenlijke waarde van circa EUR 900 miljoen. Ik zie tal van groeimogelijkheden voor Philips door gebruik te maken van ons diepgaande inzicht in de behoeften van zowel zorgprofessionals als consumenten om onze klanten innovatieve zorgoplossingen te bieden. Philips heeft zich omgevormd tot een wereldwijde marktleider op het gebied van gezondheidstechnologie. Dat wordt nu ook erkend doordat de Industry Classification Benchmark van de FTSE Group de classificatie van ons aandeel onlangs heeft herzien: het behoort voortaan tot de categorie ‘Health Care Industry’. Op onze producten en gerelateerde diensten zijn verschillende voorschriften en normen van toepassing. We zetten ons in voor kwaliteit en we hebben de afgelopen jaren aanzienlijke investeringen gedaan om op dit gebied vooruitgang te boeken. Op dit moment zijn we in gesprek met het Amerikaanse ministerie van Justitie, dat optreedt namens de FDA, naar aanleiding van inspecties in en vóór 2015 die met name gericht waren op onze activiteiten in de VS op het gebied van externe defibrillatoren. Hoewel de gesprekken nog lopen, verwachten we dat hiervan een betekenisvol effect zal uitgaan voor de bedrijfsvoering van dit onderdeel. Ondanks deze kwestie en de toegenomen onzekerheid op de markten waarin we actief zijn, zullen we onze onderliggende prestaties blijven verbeteren met als doel de komende drie tot vier jaar een groei van de vergelijkbare omzet met 4-6% en een verbetering van de gecorrigeerde EBITA met gemiddeld 100 basispunten per jaar.” HealthTech “Our Accelerate! transformation program continued to deliver operational improvements across our businesses. We are pleased that our growth initiatives - such as the successful integration of Volcano - continue to pay off, contributing to the 5% comparable sales growth and significant margin expansion across all our segments.” In the fourth quarter, the Personal Health businesses grew by 7% on a comparable basis, with growth across the portfolio, led by double-digit growth in Health & Wellness and high-single-digit growth in Domestic Appliances; the Adjusted EBITA margin improved by 100 basis points. The Diagnosis & Treatment businesses posted comparable sales growth of 3%, and the Adjusted EBITA margin improved by 280 basis points, driven by Image-Guided Therapy and Diagnostic Imaging. In the Connected Care & Health Informatics businesses, comparable sales increased 4%, driven by mid-single-digit growth in Patient Care & Monitoring Solutions and Population Health Management, and the Adjusted EBITA margin improved by 50 basis points. Following strong equipment-order intake growth in the third quarter, order intake in the fourth quarter on a currency-comparable basis was in line with 2015’s very strong fourth quarter, as expected by the company. Of the various long-term strategic partnership agreements that were signed in the fourth quarter, Philips only includes near-term business in the calculation of the order intake, as per company policy. Philips Lighting In the fourth quarter, Adjusted EBITA improved by 180 basis points to 9.8% of sales, while comparable sales declined by 3% and free cash flow amounted to EUR 272 million. Full details about the financial performance of Philips Lighting in the fourth quarter were published on January 23, 2017. The related report can be accessed here. Following the listing of Philips Lighting in Amsterdam, Philips holds a 71.225% stake with the aim of fully selling down over the next several years. As the majority shareholder in Philips Lighting, Philips continues to consolidate the financial results of Philips Lighting. Philips Group Other Group cost savings In the fourth quarter, overhead cost savings amounted to EUR 47 million, the Design for Excellence (DfX) program generated EUR 163 million of incremental procurement savings, and the End2End process improvement program achieved EUR 52 million in productivity gains. In 2016, the three cost savings programs all delivered ahead of plan. The company achieved EUR 269 million of gross savings in overhead costs, EUR 418 million of gross savings in procurement, and EUR 204 million of productivity savings from the End2End program. Sale of Lumileds & Automotive Philips has signed an agreement to sell an 80.1% interest in the combined Lumileds and Automotive businesses to certain funds managed by affiliates of Apollo Global Management, LLC. Philips will retain the remaining 19.9% interest. The transaction is expected to be completed in the first half of 2017, subject to customary closing conditions, including the relevant regulatory approvals. Miscellaneous On December 20, 2016, Philips announced its intention to redeem the outstanding 5.750% Notes due 2018 with an aggregate principal amount of USD 1.25 billion. The transaction was completed on January 20, 2017 and resulted in a charge in the fourth quarter of 2016 of USD 66 million (EUR 62 million), reflected in the Financial income and expenses line on the income statement. The cash outflow in the first quarter of 2017 will be USD 1,314 million (approximately EUR 1,247 million) excluding accrued interest. The transaction contributes to Philips’ plan to reduce its annual interest expenses by approximately EUR 100 million. Fourth quarter and Annual Results 2016 - Quarterly Report Presentation Fourth quarter and Annual Results 2016 - Quarterly Results Presentation Conference call and audio webcast A conference call with Frans van Houten, CEO, and Abhijit Bhattacharya, CFO, to discuss the results will start at 10:00AM CET, January 24, 2017. A live audio webcast of the conference call will be available through the link below. Q4 2016 - Fourth quarter 2016 results conference call audio webcast More information about Frans van Houten and Abhijit Bhattacharya Click here for Mr. van Houten's CV and images Click here for Mr. Bhattacharya's CV and images

Over het geheel was 2016 een beslissend jaar, waarin we belangrijke strategische stappen hebben gezet bij de omvorming van Philips tot marktleider op het gebied van gezondheidstechnologie, inclusief de succesvolle notering van Philips Lighting en het zekerstellen van een goede toekomst voor de gecombineerde activiteiten van Lumileds en Automotive. In operationeel opzicht hebben we aanzienlijke verbeteringen gerealiseerd met een vergelijkbare omzetgroei over het jaar van 3%, een verbetering van de gecorrigeerde EBITA-marge met 130 basispunten en een operationele kasstroom van EUR 1,9 miljard voor de Philips-groep.

Quarterly Report

About Royal Philips

Royal Philips (NYSE: PHG, AEX: PHIA) is a leading health technology company focused on improving people's health and enabling better outcomes across the health continuum from healthy living and prevention, to diagnosis, treatment and home care. Philips leverages advanced technology and deep clinical and consumer insights to deliver integrated solutions. Headquartered in the Netherlands, the company is a leader in diagnostic imaging, image-guided therapy, patient monitoring and health informatics, as well as in consumer health and home care. Philips' health technology portfolio generated 2016 sales of EUR 17.4 billion and employs approximately 71,000 employees with sales and services in more than 100 countries. News about Philips can be found at www.philips.com/newscenter.

Forward-looking statements and other important information

This document and the related oral presentation, including responses to questions following the presentation, contain certain forward-looking statements with respect to the financial condition, results of operations and business of Philips and certain of the plans and objectives of Philips with respect to these items. Examples of forward-looking statements include statements made about the strategy, estimates of sales growth, future EBITA, future developments in Philips’ organic business and the completion of acquisitions and divestments. By their nature, these statements involve risk and uncertainty because they relate to future events and circumstances and there are many factors that could cause actual results and developments to differ materially from those expressed or implied by these statements. These factors include but are not limited to: domestic and global economic and business conditions; developments within the euro zone; the successful implementation of Philips’ strategy and the ability to realize the benefits of this strategy; the ability to develop and market new products; changes in legislation; legal claims; changes in exchange and interest rates; changes in tax rates; pension costs and actuarial assumptions; raw materials and employee costs; the ability to identify and complete successful acquisitions, and to integrate those acquisitions into the business; the ability to successfully exit certain businesses or restructure the operations; the rate of technological changes; political, economic and other developments in countries where Philips operates; industry consolidation and competition; and the state of international capital markets as they may affect the timing and nature of the dispositions by Philips of its interests in Philips Lighting and the combined Lumileds and Automotive businesses. As a result, Philips’ actual future results may differ materially from the plans, goals and expectations set forth in such forward-looking statements. For a discussion of factors that could cause future results to differ from such forward-looking statements, see the Risk management chapter included in the Annual Report 2015. Third-party market share data Statements regarding market share, including those regarding Philips’ competitive position, contained in this document are based on outside sources such as research institutes, industry and dealer panels in combination with management estimates. Where information is not yet available to Philips, those statements may also be based on estimates and projections prepared by outside sources or management. Rankings are based on sales unless otherwise stated. Use of non-GAAP information In presenting and discussing the Philips Group financial position, operating results and cash flows, management uses certain non-GAAP financial measures. These non-GAAP financial measures should not be viewed in isolation as alternatives to the equivalent IFRS measures and should be used in conjunction with the most directly comparable IFRS measures. Non-GAAP financial measures do not have standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. A reconciliation of these non-GAAP measures to the most directly comparable IFRS measures is contained in this document. Further information on non-GAAP measures can be found in the Annual Report 2015. Use of fair-value measurements In presenting the Philips Group financial position, fair values are used for the measurement of various items in accordance with the applicable accounting standards. These fair values are based on market prices, where available, and are obtained from sources that are deemed to be reliable. Readers are cautioned that these values are subject to changes over time and are only valid at the balance sheet date. When quoted prices or observable market data are not readily available, fair values are estimated using appropriate valuation models and unobservable inputs. Such fair value estimates require management to make significant assumptions with respect to future developments, which are inherently uncertain and may therefore deviate from actual developments. Critical assumptions used are disclosed in the Annual Report 2015. Independent valuations may have been obtained to support management’s determination of fair values. Presentation All amounts are in millions of euros unless otherwise stated. All reported data is unaudited. Financial reporting is in accordance with the accounting policies as stated in the Annual Report 2015, unless otherwise stated. Prior-period financial statements have been restated to reflect a reclassification of net defined-benefit post-employment plan obligations to Long-term provisions in accordance with the accounting policies as stated in the Semi-annual Report of 2016. Market Abuse Regulation This press release contains inside information within the meaning of Article 7(1) of the EU Market Abuse Regulation.Article 7(1) of the EU Market Abuse Regulation.

Forward-looking statements

Onderwerpen

Contact

Steve Klink

Philips Global Press Office Tel: +31 6 10888824

You are about to visit a Philips global content page

Continue

Ben Zwirs

Philips Global Press Office Tel: +31 6 1521 3446

You are about to visit a Philips global content page

ContinueBusiness Highlights Q4 2016

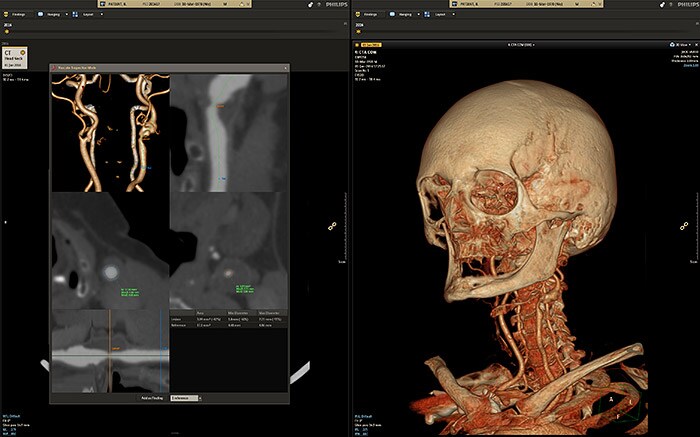

Philips is first to bring adaptive intelligence to radiology, delivering a new approach to how radiologists see, seek and share patient information

Philips highlights cloud-based innovations at the forefront of digital health during CES

Philips Receives 2016 Best in KLAS Award in Ultrasound