Philips behaalt in het eerste kwartaal een vergelijkbare omzetgroei van 2% naar EUR 5,3 miljard en een operationeel resultaat van EUR 327 miljoen

april 28, 2015

Hoogtepunten eerste kwartaal “Het is bemoedigend dat er in het eerste kwartaal van 2015 weer sprake is van omzetgroei, met name als gevolg van opnieuw uitstekende prestaties van Consumer Lifestyle en de positieve vergelijkbare omzetgroei bij Healthcare. We zagen een stijging van de orderontvangst, hoewel de marktomstandigheden voor Healthcare lastig zijn gebleven. In lijn met onze strategie om een groter deel van de mogelijkheden voor HealthTech binnen de gehele zorgketen te benutten, hebben we onze investeringen opgevoerd in onder meer zorg-IT, gepersonaliseerde zorgoplossingen en onze kwaliteitssystemen. Tevens hebben we onze positie op de groeiende markt voor beeldgestuurde therapie aanzienlijk verbeterd met de overname van Volcano. Onze investeringen, in combinatie met negatieve wisselkoerseffecten, zijn de voornaamste redenen voor de lage winstgevendheid van Healthcare in het eerste kwartaal. We blijven goede vooruitgang boeken bij het opvoeren van de productie en leveringen vanuit onze productiefaciliteit in Cleveland, en we liggen goed op koers met de uitvoering van ons jaarplan voor winstverbetering van onze activiteiten op het gebied van diagnostische beeldvorming. We zagen opnieuw een sterke omzetgroei en een verbetering van de winstgevendheid van onze LED-activiteiten, terwijl sprake was van een snellere teruggang van onze conventionele verlichtingsactiviteiten en achterblijvende prestaties van ons onderdeel Professional Lighting in Noord-Amerika. We blijven onze conventionele verlichtingsactiviteiten proactief rationaliseren en hebben vertrouwen in het vermogen van deze activiteiten om een aantrekkelijk kasstroom- en winstgevendheidsprofiel te behouden. We zijn verheugd over de overeenkomst die is gesloten voor de verkoop van een meerderheidsbelang in de gecombineerde activiteit voor LED-componenten en autoverlichting aan een consortium onder leiding van GO Scale Capital. We verwachten deze transactie in het derde kwartaal van 2015 te kunnen afronden, onder voorbehoud van goedkeuring van toezichthoudende instanties. Voor 2015 verwachten we een bescheiden groei van de vergelijkbare omzet en blijven we ons richten op een verbetering van de operationele resultaten teneinde een stijging van de EBITA-marge te bewerkstelligen. Ons doeltraject voor 2016, zoals aangekondigd in januari, blijft ongewijzigd.” Accelerate! and Separation Update “Our Accelerate! program continues to drive improvements across the organization, resulting in enhanced customer centricity and service levels, faster time-to-market for our innovations, strengthened quality and compliance systems, and better cost productivity. In Healthcare, we were able to reduce the Ingenia MRI installation time by 60% and installation cost by 30%, by redesigning and harmonizing the end-to-end processes across the equipment installation value chain. In Consumer Lifestyle, the deployment of Lean allowed the Male Grooming team to reduce the lead-time for development and launch of a new range of shavers by 30%. The team was able to simplify the end-to-end processes and re-use existing technology platforms. In Lighting, thanks to a faster time-to-market, a new range of basic LED lamps with a price point below USD 5.00 was successfully launched for the North American market within only four months. We are making good progress in setting up two stand-alone, fit-for-purpose companies. We are also working on defining the optimal infrastructure and right perimeter for each business, including tax and legal structures, real estate footprint and IT systems. We have simplified the operating model and strengthened our leadership team, most recently with Rob Cascella joining us to oversee our cluster of imaging businesses. Rob was previously CEO of Hologic and brings a wealth of healthcare experience to Philips.” The transition of the Lighting business into a separate legal structure will take at least until the end of 2015, in order to be ready for the separation, which is currently intended to be effectuated through an IPO in the first half of 2016. At the same time, alternatives will continue to be carefully reviewed. Further updates will be provided over the course of the year. The company continues to estimate that separation costs will be in the range of EUR 300-400 million in 2015. Overhead cost savings amounted to EUR 19 million in the first quarter. The Design for Excellence (DfX) program generated EUR 47 million of incremental savings in procurement in the quarter. Our End2End productivity program achieved EUR 37 million in productivity improvements. As of March 31, 2015, Philips had completed 50% of the EUR 1.5 billion share buy-back program. Q1 2015 Financial and Operational Overview Healthcare Healthcare comparable sales grew 1% year-over-year. Excluding restructuring and acquisition-related charges and other items, EBITA margin was 5.4%, down from 8.8% year-on-year, mainly driven by investments and remediation costs. Currency-comparable order intake showed low-single-digit growth, with positive performance in Europe, North America and other growth geographies partially offset by China. “We were pleased that order intake and sales returned to growth, despite a challenging healthcare environment. Performance at recently acquired Volcano was on track in the first quarter. Our ability to engage with customers on end-to-end solutions across the health continuum is increasingly proving to be a defining competitive advantage. We closed additional multi-year contracts, including a sevenyear agreement with Providence Health & Services in the US and a multi-year agreement with the Kenyan Ministry of Health. We also signed a multi-year collaboration agreement with Janssen Pharmaceutica to develop a new handheld blood test.” Consumer Lifestyle Consumer Lifestyle comparable sales increased by 10%. EBITA margin, excluding restructuring and acquisition-related charges and other items, was 11.4% of sales, compared to 10.6% of sales in Q1 2014. The increase was largely due to a combination of operational leverage and product mix, which was partially offset by negative currency effects. “Building on our strategy to deliver locally relevant innovations through strong marketing activation and increased share of online sales, our Consumer Lifestyle business continued to deliver great results and market share gains, with a particularly strong performance from our Health & Wellness portfolio. For example, Philips is uniquely positioned to develop the Oral Health Care market. We continue to introduce exciting innovations, including the Philips Sonicare for Kids Connected toothbrush, the Sonicare AirFloss Ultra and the Adaptive Clean brush head. By making our products connected, there is future potential for data generation and integration into the cloud-based HealthSuite Digital Platform to ultimately provide total health and well-being solutions.” Lighting Lighting (excluding the combined businesses of Lumileds and Automotive) comparable sales declined 3% year-on-year. On a nominal basis, sales increased by 9%, mainly due to positive currency effects. LED-lighting sales grew 25%, offset by a decline of 16% in overall conventional lighting sales. LED sales now represent 39% of total Lighting sales, compared to 30% in Q1 2014. EBITA margin, excluding restructuring and acquisition-related charges and other items, amounted to 8.4%, compared to 8.0% in Q1 2014. The increase was mainly driven by improved operational performance of LED and Professional Lighting Solutions, partly offset by the decline in conventional. “We are pleased with the continued increase in LED margins, while having to manage through a faster-than-expected decline in conventional lighting and unsatisfactory overall performance in China and North America, which we are actively addressing. We are expanding our portfolio of connected lighting products for the home with innovations such as Philips Hue Phoenix, the first luminaire that provides dimmable white light. We also made further inroads with our CityTouch lighting systems, with Los Angeles, for example, adopting an advanced Philips management system that uses mobile and cloud-based technologies to control its street lighting. Philips’ CityTouch connected lighting management system is now used in more than 250 cities globally.” Innovation, Group & Services Sales increased to EUR 169 million in the first quarter of 2015 from EUR 138 million in the first quarter of 2014, mainly due to higher onetime licensing revenue in IP Royalties. EBITA was a net cost of EUR 89 million, compared to a net cost of EUR 103 million in the first quarter of 2014. “To further strengthen the digital pathology business within our Healthcare Incubator, we entered into a joint development agreement with Mount Sinai Health System in New York to create a state-of-the-art digital pathology database from hundreds of thousands of tissue samples and to develop innovative algorithms to ultimately enable more personalized patient care. In the first quarter, we completed the de-risking of the Dutch pension plan initiated in 2014, through a final payment of EUR 171 million. Consequently, we will apply defined-contribution pension accounting for the Dutch plan from the second quarter onwards. We intend to pursue further substantial pension de-risking opportunities in other geographies in the coming quarters and will report on our progress later in the year.” Quarterly Report Presentation Conference call and audio webcast A conference call with Frans van Houten, CEO, and Ron Wirahadiraksa, CFO, to discuss the results, will start at 10:00AM CET. A live audio webcast of the conference call will be available through the link below. Q1 2015 conference call audio webcast More information about Frans van Houten and Ron Wirahadiraksa Click here for Mr. van Houten's CV and images Click here for Mr. Wirahadiraksa's CV and images

Acquisition of Volcano

Philips has strengthened its leadership position in the fast-growing image-guided therapy market with the acquisition of Volcano. The new business received the CE Mark and US FDA clearance for its next generation iFR Scout measurement technology, further expanding its broad portfolio of imaging and measurement catheters for cardiovascular applications.

Philips has strengthened its leadership position in the fast-growing image-guided therapy market with the acquisition of Volcano. The new business received the CE Mark and US FDA clearance for its next generation iFR Scout measurement technology, further expanding its broad portfolio of imaging and measurement catheters for cardiovascular applications.

Philips launched MobileDiagnost Opta

Expanding its product portfolio for the performance segment, Philips launched MobileDiagnost Opta, a compact, mobile digital x-ray system with a wide range of diagnostic capabilities, optimized for ease of use in crowded environments like Emergency Departments, Intensive Care Units and Operating Rooms.

Expanding its product portfolio for the performance segment, Philips launched MobileDiagnost Opta, a compact, mobile digital x-ray system with a wide range of diagnostic capabilities, optimized for ease of use in crowded environments like Emergency Departments, Intensive Care Units and Operating Rooms.

The Oral Healthcare business delivered double-digit growth

Through the recruitment of new users as well as expanded distribution, the Oral Healthcare business delivered double-digit growth, with a strong performance in important markets such as North America, Germany, the UK and China. The business continues to bring exciting innovations to market, including the introduction of the Philips Sonicare for Kids Connected toothbrush, the Sonicare AirFloss Ultra and the Adaptive Clean brush head at the International Dental Show, the world’s leading trade fair for the dental sector.

Through the recruitment of new users as well as expanded distribution, the Oral Healthcare business delivered double-digit growth, with a strong performance in important markets such as North America, Germany, the UK and China. The business continues to bring exciting innovations to market, including the introduction of the Philips Sonicare for Kids Connected toothbrush, the Sonicare AirFloss Ultra and the Adaptive Clean brush head at the International Dental Show, the world’s leading trade fair for the dental sector.

Innovations based on local insights continue to deliver strong results for Kitchen Appliances

Innovations based on local insights, coupled with an ongoing focus on global propositions, continue to deliver strong results for Kitchen Appliances. The new Philips Omni Spiral rice cooker with superior induction heating technology was successfully introduced in China, and the Philips Airfryer range continues to strengthen Philips’ position in the home across markets including China, Germany and the Benelux.

Innovations based on local insights, coupled with an ongoing focus on global propositions, continue to deliver strong results for Kitchen Appliances. The new Philips Omni Spiral rice cooker with superior induction heating technology was successfully introduced in China, and the Philips Airfryer range continues to strengthen Philips’ position in the home across markets including China, Germany and the Benelux.

Get the light that you want, everywhere you want in and around your home

Philips expanded its portfolio of connected lighting products for the home by introducing Philips Hue Phoenix, a luminaire providing tunable white light, and Philips Hue Go, an iF Design award-winning, portable wireless luminaire, both featuring the smart connectivity features of Philips Hue.

Philips expanded its portfolio of connected lighting products for the home by introducing Philips Hue Phoenix, a luminaire providing tunable white light, and Philips Hue Go, an iF Design award-winning, portable wireless luminaire, both featuring the smart connectivity features of Philips Hue.

Philips made further inroads with its CityTouch lighting systems

Philips made further inroads with its CityTouch lighting systems, with Los Angeles adopting an advanced Philips management system that uses mobile and cloud-based technologies to control its street lighting. Philips’ CityTouch connected lighting management system is now used in more than 250 cities globally.

Philips made further inroads with its CityTouch lighting systems, with Los Angeles adopting an advanced Philips management system that uses mobile and cloud-based technologies to control its street lighting. Philips’ CityTouch connected lighting management system is now used in more than 250 cities globally.

Philips and Mount Sinai Health System collaborate to advance clinical research

Growing Philips’ digital pathology business through its technology leadership, the company signed a joint development agreement with the Mount Sinai Health System in New York to create a digital pathology database from hundreds of thousands of analog tissue samples and to develop innovative algorithms to ultimately enable more personalized patient care.

Growing Philips’ digital pathology business through its technology leadership, the company signed a joint development agreement with the Mount Sinai Health System in New York to create a digital pathology database from hundreds of thousands of analog tissue samples and to develop innovative algorithms to ultimately enable more personalized patient care.

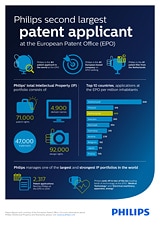

Philips becomes second largest patent applicant at the European Patent Office

Philips became the world’s second-largest patent applicant for patents filed at the European Patent Office (EPO). With a total number of 2,317 patent applications filed at the EPO in 2014, an increase of 26% compared to 2013, Philips is the top European based company on the Patent Applicant Ranking list.

Philips became the world’s second-largest patent applicant for patents filed at the European Patent Office (EPO). With a total number of 2,317 patent applications filed at the EPO in 2014, an increase of 26% compared to 2013, Philips is the top European based company on the Patent Applicant Ranking list.

For further information, please contact:

Steve Klink

Philips Group Communications

Tel: +31 6 10888824

E-mail: steve.klink@philips.com

Joost Akkermans

Philips Group Communications

Tel.: +31 6 3175 8996

E-mail: joost.akkermans@philips.com

About Royal Philips

Royal Philips (NYSE: PHG, AEX: PHIA) is a diversified health and well-being company, focused on improving people’s lives through meaningful innovation in the areas of Healthcare, Consumer Lifestyle and Lighting. Headquartered in the Netherlands, Philips posted 2014 sales of EUR 21.4 billion and employs approximately 108,000 employees with sales and services in more than 100 countries. The company is a leader in cardiac care, acute care and home healthcare, energy efficient lighting solutions and new lighting applications, as well as male shaving and grooming and oral healthcare. News from Philips is located at www.philips.com/newscenter.

Forward-looking statements

This document and the related oral presentation, including responses to questions following the presentation, contain certain forward-looking statements with respect to the financial condition, results of operations and business of Philips and certain of the plans and objectives of Philips with respect to these items. Examples of forward-looking statements include statements made about the strategy, estimates of sales growth, future EBITA, future developments in Philips’ organic business and the completion of acquisitions and divestments. By their nature, these statements involve risk and uncertainty because they relate to future events and circumstances and there are many factors that could cause actual results and developments to differ materially from those expressed or implied by these statements. These factors include but are not limited to domestic and global economic and business conditions, developments within the euro zone, the successful implementation of Philips’ strategy and the ability to realize the benefits of this strategy, the ability to develop and market new products, changes in legislation, legal claims, changes in exchange and interest rates, changes in tax rates, pension costs and actuarial assumptions, raw materials and employee costs, the ability to identify and complete successful acquisitions, including Volcano, and to integrate those acquisitions into the business, the ability to successfully exit certain businesses or restructure the operations, the rate of technological changes, political, economic and other developments in countries where Philips operates, industry consolidation and competition. As a result, Philips’ actual future results may differ materially from the plans, goals and expectations set forth in such forward-looking statements. For a discussion of factors that could cause future results to differ from such forward-looking statements, see the Risk management chapter included in the Annual Report 2014. Third-party market share data Use of non-GAAP information Use of fair-value measurements Presentation The presentation of certain prior-year information has been reclassified to conform to the current-year presentation. In 2014, we announced plans to establish two standalone companies focused on the HealthTech and Lighting Solutions opportunities. The proposed separation of the Lighting business impacts all businesses and markets as well as all supporting functions and all assets and liabilities of the Group. Philips expects the separation will take approximately 12-18 months. We expect to continue reporting in the existing structure until the changes in the way we allocate resources and analyze performance in the new structure have been completed.

Statements regarding market share, including those regarding Philips’ competitive position, contained in this document are based on outside sources such as research institutes, industry and dealer panels in combination with management estimates. Where information is not yet available to Philips, those statements may also be based on estimates and projections prepared by outside sources or management. Rankings are based on sales unless otherwise stated.

In presenting and discussing the Philips Group financial position, operating results and cash flows,

management uses certain non-GAAP financial measures. These non-GAAP financial measures should not be viewed in isolation as alternatives to the equivalent IFRS measures and should be used in conjunction with the most directly comparable IFRS measures. Non-GAAP financial measures do not have standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. A reconciliation of these non-GAAP measures to the most directly comparable IFRS measures is contained in this document. Further information on non-GAAP measures can be found in the Annual Report 2014.

In presenting the Philips Group financial position, fair values are used for the measurement of various items in accordance with the applicable accounting standards. These fair values are based on market prices, where available, and are obtained from sources that are deemed to be reliable. Readers are cautioned that these values are subject to changes over time and are only valid at the balance sheet date. When quoted prices or observable market data are not readily available, fair values are estimated using appropriate valuation models and unobservable inputs. Such fair value estimates require management to make significant assumptions with respect to future developments, which are inherently uncertain and may therefore deviate from actual developments. Critical assumptions used are disclosed in the Annual Report 2014. Independent valuations may have been obtained to support management’s determination of fair values.

All amounts are in millions of euros unless otherwise stated. All reported data is unaudited. Financial reporting is in accordance with the accounting policies as stated in the Annual Report 2014, unless otherwise stated.