jul 25, 2022

Philips maakt cijfers tweede kwartaal 2022 bekend

Prestaties van Philips beïnvloed door tegenwind; sterke orderportefeuille en verbeterde toelevering van onderdelen zullen naar verwachting vanaf de tweede helft van 2022 zorgen voor groei en een verbetering van de winstgevendheid

Hoogtepunten

Frans van Houten, CEO van Koninklijke Philips: “In al onze bedrijfsonderdelen hebben we onze activiteiten op het gebied van productiviteit, prijsstelling en versterking van de veerkracht van de toeleveringsketen opgevoerd om de aanhoudende tegenwind en de bijbehorende risico's in te dammen. De positieve impact van deze activiteiten, gekoppeld aan de kracht van onze orderportefeuille en de verbeterde toelevering van onderdelen, geven mij het vertrouwen dat we de groei vanaf het derde kwartaal zullen hervatten, resulterend in een vergelijkbare omzetgroei van 6-9% en een verbeterde winstgevendheid in de tweede helft van het jaar. Voor het volledige jaar 2022 verwachten we 1-3% groei in vergelijkbare omzet en een gecorrigeerde EBITA-marge van circa 10% te realiseren.

De vraag naar onze producten blijft hoog, zoals blijkt uit de verdere groei van onze toch al sterke orderportefeuille. Dit bevestigt de relevantie van onze strategie en ons innovatieportfolio voor onze klanten. In het tweede kwartaal steeg onze vergelijkbare orderontvangst met 1%. Hierin is een negatief effect van 5 procentpunten inbegrepen gerelateerd aan China. We hebben samengewerkt met nog eens 19 ziekenhuisgroepen om hen te helpen de zorgverlening te transformeren en de productiviteit van hun personeel te verhogen. In onze activiteiten op het gebied van persoonlijke gezondheid hebben we in Noord-Amerika voor het tweede achtereenvolgende kwartaal een vergelijkbare omzetgroei in de dubbele cijfers gerealiseerd.

Onze prestaties in het tweede kwartaal werden beïnvloed door wereldwijde, sectorbrede uitdagingen, waaronder toeleveringstekorten, lockdownmaatregelen in China in verband met COVID, inflatiedruk en de oorlog tussen Rusland en Oekraïne. Dit resulteerde in een vergelijkbare omzetdaling van 7% en een gecorrigeerde EBITA-marge van 5,2%. De impact van de COVID-lockdowns had aanzienlijke gevolgen voor onze activiteiten in China. Hier daalden de vergelijkbare omzet en orderontvangst in het kwartaal met bijna 30%. De productie in verschillende van onze fabrieken, evenals die van onze toeleveranciers in China, werd twee maanden opgeschort. Dit verergerde de wereldwijde uitdagingen op het gebied van de toeleveringsketen en de kostenproblematiek. De lockdowns in China hadden een direct effect van 120 basispunten op de gecorrigeerde EBITA-marge van de Groep als gevolg van lagere verkopen, en nog eens 110 basispunten vanwege onderbenutting van de fabrieken. De wereldwijde inflatie en het ongunstige kostenklimaat hadden een bijkomend effect van circa 290 basispunten op de winstgevendheid van de Groep in dit kwartaal.

Philips Respironics blijft stevige vooruitgang boeken met het reparatie- en vervangingsprogramma voor de CPAP-, BiPAP- en mechanische beademingsapparaten die onder de veiligheidsmelding van juni 2021 vallen, en heeft bemoedigende resultaten gepubliceerd met betrekking tot het uitgebreide test- en onderzoeksprogramma om de mogelijke gezondheidsrisico’s te beoordelen. We weten hoe belangrijk de betrokken apparaten zijn voor patiënten en werken er hard aan om hen zo snel mogelijk een oplossing te bieden.

Vooruitkijkend naar 2023 en daarna verwachten we, ondanks het aanhouden van de risico's en een uitdagende macro-omgeving, dat onze maatregelen met betrekking tot de toeleveringsketen volledig effect zullen hebben, wat zal resulteren in een significante verbetering van de conversie van onze orderportefeuille naar omzet. Onze prijsstelling en onze maatregelen ter verhoging van de productiviteit zullen leiden tot hogere marges. Op grond van deze maatregelen, de sterke fundamenten van onze bedrijfsactiviteiten, en rekening houdend met onze vooruitzichten voor 2022, verwachten we thans een vergelijkbare omzetgroei van 4-6% en een gecorrigeerde EBITA-marge van 14-15% in 2025, met een verdere verbetering daarna.”

Business segment performance

The Diagnosis & Treatment businesses’ comparable sales decreased 4% on the back of 16% comparable sales growth in Q2 2021. High-single-digit growth in Enterprise Diagnostic Informatics and mid-single-digit growth in Image-Guided Therapy was more than offset by a decline in Ultrasound and Diagnostic Imaging, due to specific electronic component shortages. Comparable order intake increased 3% on the back of 29% comparable order intake growth in Q2 2021, with growth across all businesses, reflecting ongoing solid demand for Philips’ portfolio. The Adjusted EBITA margin was 6.2%, mainly due to the decline in sales, cost inflation and an unfavorable mix impact, partly offset by productivity measures.

The Connected Care businesses’ comparable sales decreased 13%, mainly due to the consequences of the Respironics field action and the impact of supply chain headwinds. Comparable order intake showed a 2% decrease, while demand for Hospital Patient Monitoring and Connected Care Informatics remains robust. The Adjusted EBITA margin amounted to 1.1%, mainly due to the decline in sales and cost inflation, partly offset by productivity measures.

The Personal Health businesses’ comparable sales decreased by 5% on the back of 33% comparable sales growth in Q2 2021. Double- digit growth in North America was more than offset by double-digit declines in China and Russia. The Adjusted EBITA margin amounted to 12.4%, mainly due to the decline in sales and cost inflation.

Philips’ ongoing focus on innovation and customer partnerships resulted in the following key developments in the quarter:

Philips Respironics field action related to specific CPAP, BiPAP and mechanical ventilators

Philips Respironics continued to make solid progress with the repair and replacement program for the CPAP, BiPAP and mechanical ventilator devices affected by the June 2021 field safety notice, as well as the comprehensive test and research program to assess the possible health risks. To date, 3 million replacement devices and repair kits have been produced. Philips Respironics aims to further increase capacity and complete around 90% of the production and shipments to customers in 2022. The test results to date for the first-generation DreamStation devices, which represent the majority of the registered affected devices, are very encouraging. They show a very low prevalence of visible foam degradation, and new and used first-generation DreamStation devices passed volatile organic compound and respirable particulate emission testing.

Following the FDA’s inspection of certain of Philips Respironics’ facilities in the US in 2021 and the subsequent inspectional observations, the US Department of Justice, acting on behalf of the FDA, recently began discussions with Philips regarding the terms of a proposed consent decree to resolve the identified issues.

Capital allocation

In the second quarter, Philips issued EUR 750 million fixed-rate notes due 2027, EUR 650 million Green Innovation Notes due 2029 and EUR 600 million Sustainability Innovation Notes due 2033 under its Euro Medium Term Note program, and entered into a series of transactions to extend and optimize the company’s debt maturity profile. See here for more information on Philips' current debt structure.

Following the issuance of 14,174,568 new shares related to the share dividend, and the cancellation of 8,758,455 shares that were acquired as part of the EUR 1.5 billion share repurchase program for capital reduction purposes, Philips’ current issued share capital amounts to 889,315,082 common shares. As communicated earlier, Philips intends to have 19,571,218 shares delivered through the early settlement of forward contracts (entered into as part of the same share repurchase program) and to cancel those as well, which would result in 869,743,864 issued common shares at year-end 2022 (2021: 883,898,969).

Report

Presentation

Conference call and video webcast Frans van Houten, CEO, and Abhijit Bhattacharya, CFO, will host a conference call for investors and analysts at 10:00 am CET today to discuss the results, as well as the company’s mid-term performance roadmap. They will be joined by Roy Jakobs, Chief Business Leader Connected Care, and Francis Kim, Chief Quality & Regulatory Officer, who will provide further details on the Respironics field action and on Philips’ progress and continued efforts around quality, respectively. A live video webcast of the conference call will be available on the Philips Investor Relations website and can be accessed here. Click here for Mr. Bhattacharya's CV and images

More information about Frans van Houten and Abhijit Bhattacharya

Click here for Mr. van Houten's CV and images

Visit our interactive results hub for more on our financial and sustainability performance over the past quarter.

About Royal Philips

Royal Philips (NYSE: PHG, AEX: PHIA) is a leading health technology company focused on improving people's health and well-being, and enabling better outcomes across the health continuum – from healthy living and prevention, to diagnosis, treatment and home care. Philips leverages advanced technology and deep clinical and consumer insights to deliver integrated solutions. Headquartered in the Netherlands, the company is a leader in diagnostic imaging, image-guided therapy, patient monitoring and health informatics, as well as in consumer health and home care. Philips generated 2021 sales of EUR 17.2 billion and employs approximately 79,000 employees with sales and services in more than 100 countries. News about Philips can be found at www.philips.com/newscenter.

Forward-looking statements and other important information

Forward-looking statements

This document and the related oral presentation, including responses to questions following the presentation, contain certain forward-looking statements with respect to the financial condition, results of operations and business of Philips and certain of the plans and objectives of Philips with respect to these items. Examples of forward-looking statements include statements made about our strategy, estimates of sales growth, future Adjusted EBITA*), future restructuring and acquisition- related charges and other costs, future developments in Philips’ organic business and the completion of acquisitions and divestments. Forward-looking statements can be identified generally as those containing words such as “anticipates”, “assumes”, “believes”, “estimates”, “expects”, “should”, “will”, “will likely result”, “forecast”, “outlook”, “projects”, “may” or similar expressions. By their nature, these statements involve risk and uncertainty because they relate to future events and circumstances and there are many factors that could cause actual results and developments to differ materially from those expressed or implied by these statements.

These factors include but are not limited to: Philips’ ability to gain leadership in health informatics in response to developments in the health technology industry; Philips’ ability to transform its business model to health technology solutions and services; macroeconomic and geopolitical changes; integration of acquisitions and their delivery on business plans and value creation expectations; securing and maintaining Philips’ intellectual property rights, and unauthorized use of third-party intellectual property rights; Philips' ability to meet expectations with respect to ESG-related matters; failure of products and services to meet quality or security standards, adversely affecting patient safety and customer operations; breaches of cybersecurity; Philips' ability to execute and deliver on programs on business transformation and IT system changes and continuity; the effectiveness of our supply chain; attracting and retaining personnel; COVID and other pandemics; challenges to drive operational excellence and speed in bringing innovations to market; compliance with regulations and standards including quality, product safety and (cyber) security; compliance with business conduct rules and regulations; treasury and financing risks; tax risks; reliability of internal controls, financial reporting and management process. For a discussion of factors that could cause future results to differ from such forward-looking statements, see also the Risk management chapter included in the Annual Report 2021. Reference is also made to Risk management in the Philips semi-annual report 2022.

Third-party market share data

Statements regarding market share, contained in this document, including those regarding Philips’ competitive position, are based on outside sources such as specialized research institutes, industry and dealer panels in combination with management estimates. Where information is not yet available to Philips, market share statements may also be based on estimates and projections prepared by management and/or based on outside sources of information. Management's estimates of rankings are based on order intake or sales, depending on the business.

Market Abuse Regulation

This press release contains inside information within the meaning of Article 7(1) of the EU Market Abuse Regulation. This press release was distributed at 07:00 am CET on July 25, 2022.

Use of non-IFRS information

In presenting and discussing the Philips Group’s financial position, operating results and cash flows, management uses certain non-IFRS financial measures. These non-IFRS financial measures should not be viewed in isolation as alternatives to the equivalent IFRS measure and should be used in conjunction with the most directly comparable IFRS measures. Non-IFRS financial measures do not have standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. A reconciliation of these non-IFRS measures to the most directly comparable IFRS measures is contained in this document. Further information on non-IFRS measures can be found in the Annual Report 2021.

Use of fair value information

In presenting the Philips Group’s financial position, fair values are used for the measurement of various items in accordance with the applicable accounting standards. These fair values are based on market prices, where available, and are obtained from sources that are deemed to be reliable. Readers are cautioned that these values are subject to changes over time and are only valid at the balance sheet date. When quoted prices or observable market data are not readily available, fair values are estimated using appropriate valuation models and unobservable inputs. Such fair value estimates require management to make significant assumptions with respect to future developments, which are inherently uncertain and may therefore deviate from actual developments. Critical assumptions used are disclosed in the Annual Report 2021 In certain cases independent valuations are obtained to support management’s determination of fair values.

Presentation

All amounts are in millions of euros unless otherwise stated. Due to rounding, amounts may not add up precisely to the totals provided. All reported data is unaudited. Financial reporting is in accordance with the accounting policies as stated in the Annual Report 2021 except for the adoption of new standards and amendments to standards which are also expected to be reflected in the company's consolidated financial statements for the year ending December 31, 2022.

Prior-period amounts have been reclassified to conform to the current-period presentation; this includes immaterial organizational changes.

*) Non-IFRS financial measure. Refer to the Reconciliation of non-IFRS information

Onderwerpen

Contact

Ben Zwirs

Philips Global Press Office Tel: +31 6 1521 3446

You are about to visit a Philips global content page

Continue

Derya Guzel

Philips Investor Relations Tel: +31 20 59 77055

You are about to visit a Philips global content page

ContinueBusiness Highlights Q2 2022

New long-term strategic partnerships

Philips signed 19 new long-term strategic partnerships with hospitals in Europe, Asia, and North America, including a 10-year patient monitoring agreement with a large hospital in Germany.

FDA clearance for diagnostic imaging innovations

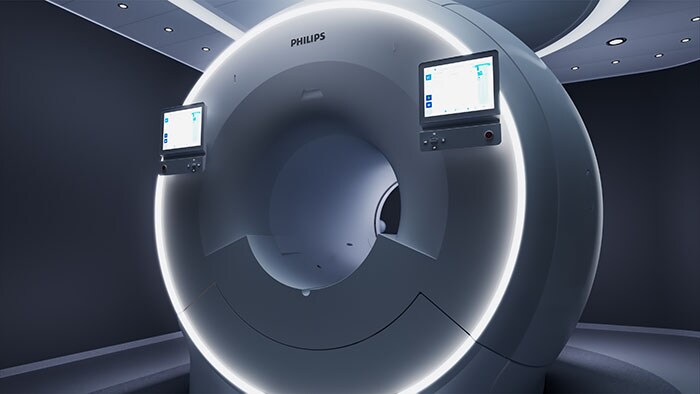

Philips received FDA clearance to market its new 7700 3.0T MR system, featuring an enhanced gradient system for Philips’ highest image quality to support a precision diagnosis.

Image guidance innovation for interventional cardiology

Building on Philips’ leadership in interventional cardiology solutions, the company launched the latest version of its EchoNavigator image-guidance tool.

Strong momentum for oral healthcare innovations in North America

Building on the successful strengthening of the company’s innovative power toothbrushes portfolio, Philips Oral Healthcare recorded continued strong double-digit comparable sales growth and market share gains in North America in the quarter.