jul 23, 2018

Philips maakt cijfers tweede kwartaal 2018 bekend

Philips behaalt in het tweede kwartaal een omzet van EUR 4,3 miljard, met een groei van de vergelijkbare omzet van 4%; het nettoresultaat uit doorlopende activiteiten bedraagt EUR 186 miljoen, en de gecorrigeerde EBITA-marge is toegenomen met 100 basispunten naar 11,2%

Kerncijfers tweede kwartaal Frans van Houten, CEO: “In het tweede kwartaal realiseerden we een vergelijkbare omzetgroei van 4%, een sterke toename van de orderontvangst met 9% en een solide verbetering van onze operationele resultaten met 100 basispunten onder invloed van onze groei- en productiviteitsprogramma’s. Ik ben verheugd over de opnieuw sterke prestatieverbetering van de Diagnosis & Treatment-activiteiten, mede dankzij de diversiteit van ons portfolio van innovatieve producten, hetgeen resulteerde in een vergelijkbare omzetgroei van 8% en een tweecijferige toename van de orderontvangst. Tegelijkertijd ervaar ik de middelhoge eencijferige groei van de orderontvangst van de Connected Care & Health Informatics-activiteiten als bemoedigend. Na een trage start zijn de resultaten van de Personal Health-activiteiten in de loop van dit kwartaal aangetrokken, en we verwachten dat dit zich in de tweede helft van het jaar zal voortzetten. Ons aanhoudende succes bij de opbouw van onze solutions-business blijkt uit het feit dat we in het kwartaal zeven langlopende strategische samenwerkingsverbanden zijn aangegaan. In Duitsland heeft Philips twee meerjarige overeenkomsten bekendgemaakt met respectievelijk Kliniken der Stadt Köln en Städtische Klinikum München voor de levering van medische beeldvormingsoplossingen ter ondersteuning van precisiediagnoses en verbeteringen op het gebied van therapie, innovatie en productiviteit. Verder ondertekenden we met de overheden van Nederland en Ethiopië een overeenkomst met een looptijd van zeven jaar voor het ontwerp, de bouw en de uitrusting van het eerste gespecialiseerde cardiologiecentrum in Ethiopië voor geavanceerde diagnose en behandeling van hartziekten. Vooruitkijkend houden we vast aan onze doelstellingen voor de periode 2017-2020, te weten een groei van de vergelijkbare omzet van 4-6% en een verbetering van de gecorrigeerde EBITA-marge met gemiddeld 100 basispunten per jaar.”

Business segments The Diagnosis & Treatment businesses recorded a double-digit increase in comparable order intake, driven by strong double-digit growth in China and North America. Comparable sales increased by 8%, with double-digit growth in Image-Guided Therapy and high-single-digit growth in Ultrasound. The Adjusted EBITA margin was 180 basis points higher than in the same period last year, mainly due to growth and operational improvements. The Connected Care & Health Informatics businesses delivered a mid-single-digit increase in comparable order intake, driven by double-digit order intake growth for Healthcare Informatics. Comparable sales growth increased 2% year-on-year, reflecting high-single-digit growth in Healthcare Informatics and low-single-digit growth in Monitoring & Analytics. The Adjusted EBITA margin improved by 40 basis points year-on-year. In the Personal Health businesses, comparable sales growth was 2%, with high-single-digit growth in Sleep & Respiratory Care and low-single-digit growth in Personal Care. The growth of the Personal Health businesses was impacted by a high-single-digit comparable sales decline in China, mainly due to an inventory alignment at our distributors and lower demand in the Air purification market. The Adjusted EBITA margin increased by 80 basis points, driven by operational improvements. Philips’ ongoing focus on innovation resulted in the following highlights in the quarter: * Philips announced the agreement to acquire EPD Solutions on June 5, 2018. The transaction was completed on July 9, 2018. Cost savings In the second quarter, procurement savings amounted to EUR 67 million. Overhead and other productivity programs resulted in savings of EUR 38 million. Philips is on track to deliver annual savings of EUR 400 million in 2018. Capital structure As part of the actions to reduce interest expenses and extend maturities, Philips completed the early redemption of the outstanding 3.750% Notes due 2022 with a principal amount of USD 1 billion (as announced in Q1 2018), resulting in a cash outflow of EUR 832 million excluding accrued interest. Furthermore, Philips entered into transactions with bondholders to redeem an aggregate principal amount of USD 72 million of the outstanding 6.875% Notes due 2038, resulting in a cash outflow of EUR 80 million excluding accrued interest. To finance the above, Philips successfully placed an aggregate principal amount of EUR 1.0 billion of Notes due 2024 and 2028. Details of Philips’ current EUR 1.5 billion share buyback program, which was initiated in the third quarter of 2017 for capital reduction purposes, can be found here. Discontinued operations In the second quarter, Discontinued operations included a net EUR 177 million negative impact related to a value adjustment of Philips’ remaining interest in Signify (formerly Philips Lighting), which was partially offset by a positive impact related to the dividends received on Signify shares. Regulatory update Philips continues to make progress in line with the terms of the consent decree, which is primarily focused on the defibrillator manufacturing in the US; this included inspections by independent auditors and continued shipments of its FRx and FR3 AEDs to markets outside of the US.

Quarterly Report Second Quarter Results 2018 - Quarterly Report Presentation Second Quarter Results 2018 - Quarterly Results Presentation Conference call and audio webcast A conference call with Frans van Houten, CEO, and Abhijit Bhattacharya, CFO, to discuss the results will start at 10:00AM CET, July 23, 2018. A live audio webcast of the conference call will be available through the link below. Q2 2018 – Second quarter 2018 results conference call audio webcast More information about Frans van Houten and Abhijit Bhattacharya Click here for Mr. van Houten's CV and images Click here for Mr. Bhattacharya's CV and images

Visit our interactive results hub for more on our financial and sustainability performance over the past quarter, including the latest version of our dynamic Lives Improved world map.

About Royal Philips

Royal Philips (NYSE: PHG, AEX: PHIA) is a leading health technology company focused on improving people's health and enabling better outcomes across the health continuum from healthy living and prevention, to diagnosis, treatment and home care. Philips leverages advanced technology and deep clinical and consumer insights to deliver integrated solutions. Headquartered in the Netherlands, the company is a leader in diagnostic imaging, image-guided therapy, patient monitoring and health informatics, as well as in consumer health and home care. Philips generated 2017 sales of EUR 17.8 billion and employs approximately 75,000 employees with sales and services in more than 100 countries. News about Philips can be found at www.philips.com/newscenter.

Forward-looking statements and other important information

Forward-looking statements These factors include but are not limited to: global economic and business conditions; political instability, including developments within the European Union, with adverse impact on financial markets; the successful implementation of Philips’ strategy and the ability to realize the benefits of this strategy; the ability to develop and market new products; changes in legislation; legal claims; changes in currency exchange rates and interest rates; future changes in tax rates and regulations, including trade tariffs; pension costs and actuarial assumptions; changes in raw materials prices; changes in employee costs; the ability to identify and complete successful acquisitions, and to integrate those acquisitions into the business, the ability to successfully exit certain businesses or restructure the operations; the rate of technological changes; cyber-attacks, breaches of cybersecurity; political, economic and other developments in countries where Philips operates; industry consolidation and competition; and the state of international capital markets as they may affect the timing and nature of the disposal by Philips of its remaining interests in Signify (formerly Philips Lighting). As a result, Philips’ actual future results may differ materially from the plans, goals and expectations set forth in such forward-looking statements. For a discussion of factors that could cause future results to differ from such forward-looking statements, see the Risk management chapter included in the Annual Report 2017. Third-party market share data Statements regarding market share, including those regarding Philips’ competitive position, contained in this document are based on outside sources such as research institutes, industry and dealer panels in combination with management estimates. Where information is not yet available to Philips, those statements may also be based on estimates and projections prepared by outside sources or management. Rankings are based on sales unless otherwise stated. Use of non-IFRS information In presenting and discussing the Philips Group’s financial position, operating results and cash flows, management uses certain non-IFRS financial measures. These non-IFRS financial measures should not be viewed in isolation as alternatives to the equivalent IFRS measures and should be used in conjunction with the most directly comparable IFRS measures. Non-IFRS financial measures do not have standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. A reconciliation of these non-IFRS measures to the most directly comparable IFRS measures is contained in this document. Further information on non-IFRS measures can be found in the Annual Report 2017. Use of fair value information In presenting the Philips Group’s financial position, fair values are used for the measurement of various items in accordance with the applicable accounting standards. These fair values are based on market prices, where available, and are obtained from sources that are deemed to be reliable. Readers are cautioned that these values are subject to changes over time and are only valid at the balance sheet date. When quoted prices or observable market data are not readily available, fair values are estimated using appropriate valuation models and unobservable inputs. Such fair value estimates require management to make significant assumptions with respect to future developments, which are inherently uncertain and may therefore deviate from actual developments. Critical assumptions used are disclosed in the Annual Report 2017. In certain cases independent valuations are obtained to support management’s determination of fair values. Presentation All amounts are in millions of euros unless otherwise stated. Due to rounding, amounts may not add up precisely to totals provided. All reported data is unaudited. Financial reporting is in accordance with the accounting policies as stated in the Annual Report 2017, unless otherwise stated. Market Abuse Regulation This press release contains inside information within the meaning of Article 7(1) of the EU Market Abuse Regulation.

This document and the related oral presentation, including responses to questions following the presentation, contain certain forward-looking statements with respect to the financial condition, results of operations and business of Philips and certain of the plans and objectives of Philips with respect to these items. Examples of forward-looking statements include statements made about the strategy, estimates of sales growth, future Adjusted EBITA, future developments in Philips’ organic business and the completion of acquisitions and divestments. By their nature, these statements involve risk and uncertainty because they relate to future events and circumstances and there are many factors that could cause actual results and developments to differ materially from those expressed or implied by these statements.

Onderwerpen

Contact

Ben Zwirs

Philips Global Press Office Tel: +31 6 1521 3446

You are about to visit a Philips global content page

Continue

Steve Klink

Philips Global Press Office Tel: +31 6 10888824

You are about to visit a Philips global content page

ContinueBusiness Highlights Q2 2018

Philips powers first tele-intensive care eICU program in Japan

Philips to expand its Image-Guided Therapy portfolio with the acquisition of EPD Solutions

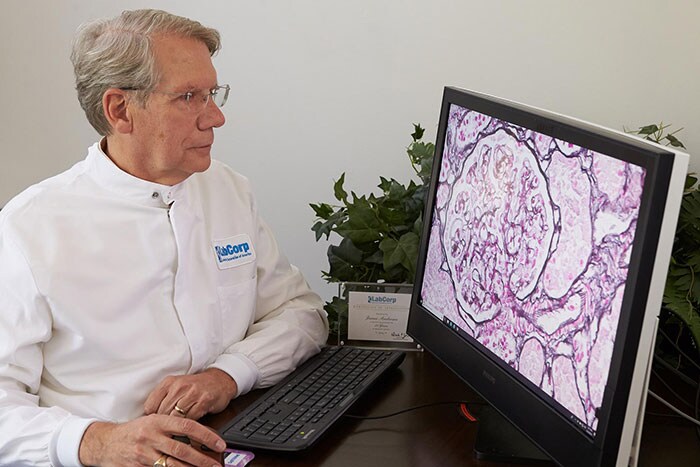

LabCorp and Philips collaborate on digital pathology to enhance the efficiency of pathology diagnostics